What is the Common Reporting Standard (CRS)? The complete informational guide

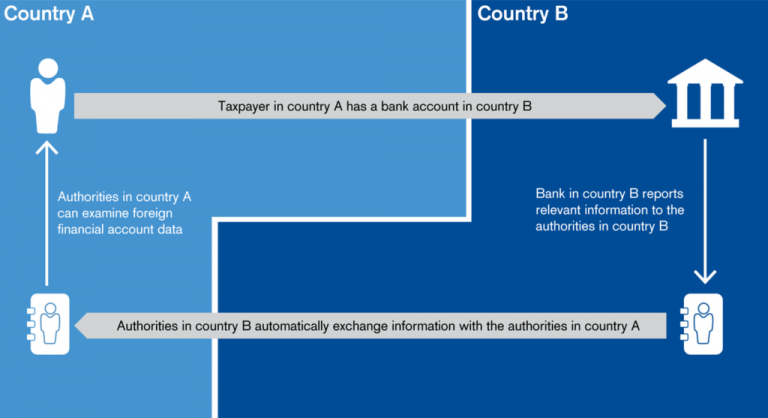

What is the Common Reporting Standard (CRS)? Over the past few years, governments and organisations all over the world have been promoting the global tax transparency agenda to minimize tax evasion. In this context, and in response to the request of the Group of Twenty (G20), the Organisation for Economic Co-operation and Development (OECD) issued the CRS