What is the Common Reporting Standard (CRS)?

Over the past few years, governments and organisations all over the world have been promoting the global tax transparency agenda to minimize tax evasion. In this context, and in response to the request of the Group of Twenty (G20), the Organisation for Economic Co-operation and Development (OECD) issued the CRS (Common Reporting Standard) framework, in order to collect and automatically report the account information of taxpayers across the countries.

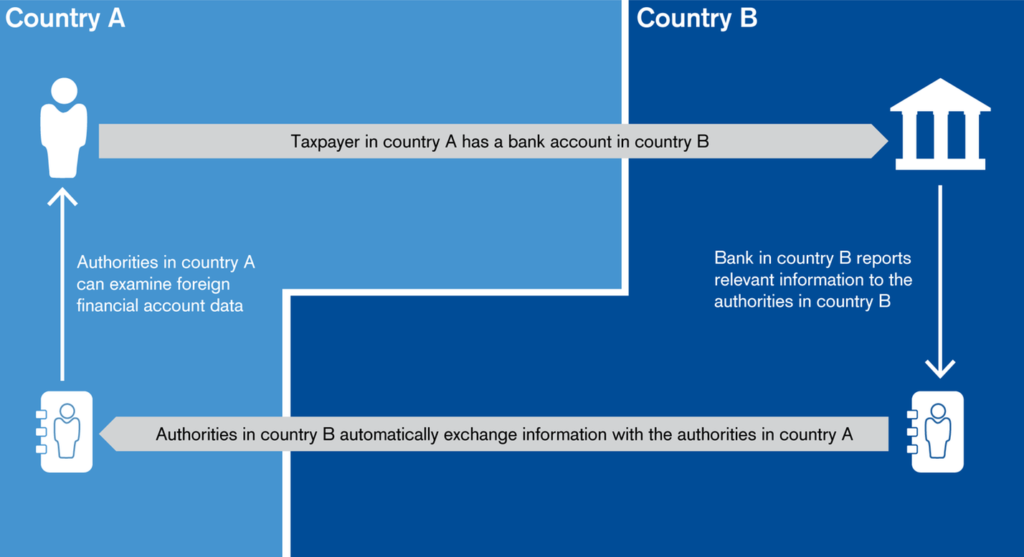

It is indeed common for taxpayers to keep bank accounts outside their country of residence, aiming, in many occasions, at hiding assets offshore. CRS assists tax authorities to acquire tax information of non-resident account holders and thus prevent tax evasion. In particular, tax authorities of each participating jurisdiction (96 countries) will collect information from the local Financial Institutions and automatically forward them to the International Revenue Service (IRS) of each tax payer’s place of tax residency.

in order to resolve any potential sense of bewilderment, in the following text we have answered some common questions:

1. How is the CRS implemented?

Financial Institutions collect specific information (see infra, question 2) of their clients’ account and forward them to the jurisdictions of their tax residence (based on his/her personal information and TIN). For this reason, under the CRS, financial institutions are required to determine the tax residence of each account holder.

The procedure to be followed is summarized in the diagram below:

2. What kind of information will be exchanged?

- Name, address, Taxpayer Identification Number and date and place of birth

- Account number

- Name and identifying the number of the reporting Financial Institution

- Account balance at the end of the relevant year

- Capital gains (dividends, interest, gross, etc.)

3. What does “tax residence” mean?

A physical person’s tax residence is the place where he has to declare his/her worldwide income in order to be taxed. The criteria vary between nations, but the main test for individuals is their physical presence for more than 183 days continuously or intermittently, within the examining tax year and having their permanent or principal residence or the center of their vital interests or earning wages in the country of tax residency.

4. Under which conditions does a new bank account open pursuant to CRS?

In order to open a new bank account, each individual will have to fill a self-certification form, in which he shall provide the bank with his Tax Identification Number (TIN). In case of providing the Bank with false personal information, high penalties are imposed.

5. What about existing accounts?

If a Financial Institution has kept the Documentary Evidence or has policies and procedures in place to ensure that the current residence address is the same as the address on the Documentary Evidence provided, it may use it as proof of tax residence.

Alternatively, the Bank may ask for a self-certification to be sought, especially if the account holder is found a tax resident of more than one countries, in which case the bank can even report the account to all jurisdictions where there is a residence address.

6. How does someone change his tax residence? Is the process automatic?

The change of tax residency is not an automatic process happening in correspondence with the change of the real residence. Rather, several procedures need to be followed. Therefore, the acquisition of a TIN by no means entails the alteration of his/her tax residence.

Nevertheless, in Greece the acquisition of AFM (TIN) in any other IRS than the IRS of Foreign Residents may be considered as an alteration of tax residence and in order for a foreigner to prove that it is not, he will have to provide the Greek tax authorities with some documents.

For example, if a Greek tax resident wishes to move in the United Kingdom, he/she has to provide the Greek tax authorities with certificates, such as certificate of tax residence, tenancy agreement/contract of employment, proving that he/she has spent more than 183 days of the previous year in the United Kingdom.

7. Why should someone change his tax residence?

In order for one to avoid double taxation, he/she should be tax resident of only one country. Otherwise, his/her worldwide income is subject to taxation in all countries of tax residency.

8. When is a foreign tax resident obliged to file income tax return (E1) in Greece

This obligation arises when someone acquires real income, taxable or exempted from taxation, from sources within Greece. The income is considered real when it is derived from sources such as wages, rents, any profits from the disposal of assets, interests from bank accounts, etc.

On the other hand, foreign tax residents are not obliged to file income tax return if they own a secondary residence, a car or decide to purchase any kind of immovable property in Greece, if said assets do not generate income.